中新社温哥华十二月九日电吕振亚 加拿大中央银行九日宣布,将银行基准利率下调七十五个基点,降至百分之一点五。

加央行此次降息幅度是二00一年十月以来最大的,也创下了半个世纪以来银行基准利率的最低纪录。

舆论认为,降息幅度高于此前预期。加央行当天发表声明说,作出再次降息的决定是基于通货膨胀率低于预期,全球经济加速下滑和加国经济走向衰退等原因。

今年十月份,加拿大央行已连续两次降低基准利率至百分之二点二五。

本月五日公布的统计数据显示,今年十一月加拿大失业率剧增,共削减了七万一千个工作,超出预期达三倍之多。而加拿大总理哈珀和财长弗莱厄蒂已承认,加拿大经济可能从今年第四季度开始陷入技术性衰退。加央行今天同时警告,全球经济可能变得越来越糟。

Canada ‘entering a recession,’ central bank slashes key rate to 1.5 per cent

Tue Dec 9, 5:39 PM

Julian Beltrame, The Canadian Press

OTTAWA – The Bank of Canada took an axe to short-term interest costs Tuesday, cutting its key rate by three quarters of a point in a move to get consumers and businesses borrowing and spending again and help revive the slumping economy.

The drop in the central bank rate to the lowest level in half a century at 1.5 per cent is aimed at loosening up the pursetrings of households and businesses. But it it will take a while for the rate cuts to wind through the national economy, which is shrinking and now is in recession.

In the meantime, many economists say, the federal government must deliver a major stimulus package of billions of dollars in infrastructure spending, targeted help to struggling industries and other confidence-enhancing moves to free up frozen credit markets and put more money into people’s pockets.

Prime Minister Stephen Harper said Tuesday’s central bank rate cut will provide “significant economic stimulus.” But he conceded more must be done in the Jan. 27 federal budget.

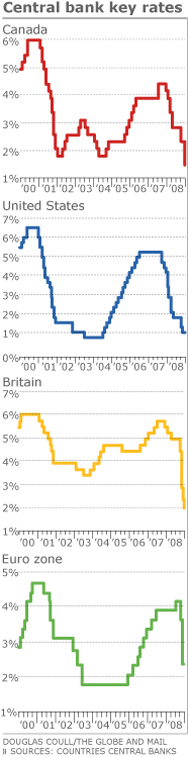

Tuesday’s cut means the Bank of Canada has reduced interest rates by about three percentage points since last year – half of that since early October – to cope with rising unemployment and thousands of job losses.

The central bank said dramatic action was needed given the rapidly deteriorating global economy and the impact of the financial crisis and plummeting commodity prices, factors that have hit Canada’s resources-based economy hard.

“The outlook for the world economy has deteriorated significantly and the global recession will be broader and deeper than previously anticipated,” the central bank said in a statement accompanying the rate cut.

“While Canada’s economy evolved largely as expected during the summer and early autumn, it is now entering a recession. The recent declines in terms of trade, real income growth, and confidence are prompting more cautious behaviour by households and businesses.”

The lower interest rates, when passed on by the commercial banks, will make it cheaper for businesses and households to borrow for expansion and consumption. Such spending boosts economic growth and provides jobs to stimulate the recessionary economy.

Given the lag time needed to get major infrastructure projects started, Scotia Capital economist Derek Holt said it was essential for the Bank of Canada to show leadership by cutting rates because Ottawa’s stimulus – when it comes – may not impact the economy for another year.

However, rate cuts alone won’t get the economy moving again. While falling borrowing costs are helpful, the tough operating environment at many businesses means they still won’t borrow money to expand until they see a spurt in orders from their customers in the battered U.S. economy or corporate confidence improves.

The same thing applies to ordinary Canadians, hit by rising debt, unemployment fears and consumer confidence at its lowest level in more than a quarter century.

Another factor that lessens the impact of Tuesday’s bank rate cut is the fact the commercial banks have not passed on the full three-quarters of a point bank rate cut to their customers because of tighter credit markets in which they operate.

Some critics say the banks are profiteering, but the bond market and other financial markets remain volatile and don’t automatically respond to central bank rate signals as they did in the past.

On Tuesday, all the big banks cut their prime lending rate by only half a point to 3.5 per cent. The prime sets the bar for many business and consumer loans, including open mortgages, but in recent months, the day-to-day credit market has pushed borrowing costs higher for consumer and car loans and many mortgages not linked to prime.

In early October, the chartered banks balked at passing through fully the Bank of Canada’s rate reduction but later made up the difference when Ottawa agreed to buy $25 billion in mortgage assets off their books and free up the money to expand credit in the economy.

The central bank’s dramatic chop to the overnight rate Tuesday was the largest since October 2001 in the aftermath of the 9-11 terrorist attacks.

A recession is commonly defined as two consecutive quarters of economic shrinkage and by that measure Canada has avoided a recession this year since there was growth in the third quarter.

However, given a sudden drop in economic activity that began in October and prospects of continued slowdown throughout early 2009, many economists have said Canada’s recession has begun in earnest.

Although most private-sector analysts had predicted a half-point cut from the central bank, Holt praised the central bank for rising to the needs of the economy.

Given the “dovish” tone of the bank statement, Holt said Canadians should expect another half-point cut at the next scheduled rate decision date on Jan. 20. He said it is possible the overnight rate – the rate banks charge each other on one-day loans – will fall below one per cent by late winter.

“Beforehand, they were criticized for not being aggressive enough but now they have come around,” Holt said.

Tuesday’s statement was the first in which the Bank of Canada was unequivocal that the country had fallen into a recession. The closest that governor Mark Carney had come previously was last month when he said recession was a distinct possibility.

Since then the vast majority of economic indicators have been in retreat, including retail sales, auto purchases, housing starts and prices, commodity prices – and dramatically – last month’s 70,600 shrinkage in jobs.

The central bank’s move was partly a “catch-up” after it did not cut rates more deeply in October, and was urgently needed because of the lack of economy-boosting spending by the Conservative federal government, commented IHS Global Insight economist Dale Orr.

“Today the cry for fiscal stimulus for Canada is loud and clear,” Orr wrote.

Although monetary and fiscal stimulus differ in the manner they boost growth, Orr said interest rates cuts are preferred by economists because their impact is quicker and can more readily be reversed when the economy recovers.

The central bank will not publish new projections for the economy until Jan. 22, just days before the next federal budget.

In its new outlook, IHS projects the Canadian economy will shrink 0.4 per cent in 2009 and won’t recover fully until late 2010.

The Bank of Canada did not predict how long the slump will last but said bold actions by governments and central banks, especially in the United States and Europe, are beginning to loosen up money markets and support world economic growth.

It said other factors are helping Canada counter the economic slowdown, including the depreciating loonie which is making exports more competitive.

After the rate reduction, the currency fell by more than a cent to below 78 cents US. but gained back some of the loss, ending the day at 79.08 cents US, down nearly two thirds of a cent.

Bank of Canada makes deep cut

HEATHER SCOFFIELD

Globe and Mail Update

December 9, 2008 at 3:59 PM EST

OTTAWA — The Bank of Canada has dramatically cut its key interest rate by a hefty three-quarters of a percentage point, blaming a “broader and deeper” global slowdown for driving Canada into recession.

The central bank’s overnight lending rate now stands at 1.50 per cent, a generational low and the likes of which have not been seen since the 1950s.

In response, however, Canada’s major banks cut their prime lending rates by only half a percentage point, to 3.5 per cent, rather than following with a full three-quarters of a point reduction.

Canada’s central bank joins a host of other central banks in making larger-than-usual rate cuts as their economies quickly fall victim to a stunning slowdown in global demand, led by a deeply troubled U.S. economy.

“While Canada’s economy evolved largely as expected during the summer and early autumn, it is now entering a recession as a result of the weakness in global economic activity,” the bank said in its first clear-cut declaration of a country in recession.

Economists had expected a somewhat smaller half-percentage-point cut, although markets were factoring in the larger cut delivered by the bank Tuesday.

The last time the Bank of Canada cut its key rate so deeply was in the panic following the terrorist attacks of September 2001.

This time, the global recession and lower commodity prices are choking off the amount of money flowing into the country and undermining confidence, prompting consumers and businesses to have second thoughts about spending, the bank said.

The bank warned that global conditions are getting worse.

“The outlook for the world economy has deteriorated significantly and the global recession will be broader and deeper than previously anticipated.”

Financial markets around the world are still “severely strained,” the bank noted, and even though governments are doing what they can to thaw the freeze in credit, “it will take some time before conditions in financial markets normalize.”

Global growth should eventually benefit from rate cuts and fiscal stimulus around the world, the bank noted.

The bank did not say when it anticipates an end to the Canadian recession. But it said that the depreciation of the dollar and slowly improving credit conditions should help.

Most economists figure the Canadian economy will contract for at least two consecutive quarters, and many peg the recession dragging on longer than that – a sentiment bolstered by the loss of 71,000 jobs in November.

Still, the Bank of Canada did not make any promises for future rate cuts. Rather, the bank pointed out that it has now cut rates by 1 1/2 percentage points in the past two months, and indicated it will keep an eye on developments to decide whether more cuts are needed.

“The bank will continue to monitor carefully economic and financial developments in judging to what extent further monetary stimulus will be required to achieve the 2 per cent inflation target over the medium term,” the statement said.

Rising inflation is no longer an obstacle to more rate cuts, economists say, and the bank also signaled that its own outlook is for a lower rate of inflation than forecast just six weeks ago.

The central bank’s key rate is normally a benchmark for other rates of lending to households and businesses. However, those lending rates have not come down as steeply as the central bank’s rate over the past year and a half, because of the global credit crisis.