Loonie hits parity

Sep 20, 2007 06:15 PM

THE CANADIAN PRESS

Boosted by high commodity prices and a weakening U.S. dollar, the loonie reached parity with the greenback Thursday for the first time in nearly 31 years, promising to boost the energy and import sectors and give consumers cheaper vacations but spelling more trouble for Canada’s industrial heartland.

The loonie, which has been gaining on its American counterpart since bottoming out below 62 cents in early 2002, has recently been on a spectacular run, up from 95 cents at the start of September and from under 90 cents last spring.

Soaring demand for Canadian commodities, ranging from oil and wheat to coal, potash, nickel and zinc – have helped propel the currency, while a weakening American economy has dragged down the greenback, the world’s most widely held and traded currency.

At 10:58 a.m. EDT, the loonie first crossed the threshold to hit $1.0004, then eased back slightly to close at 99.87 cents (U.S.), up 1.37 cents from Wednesday.

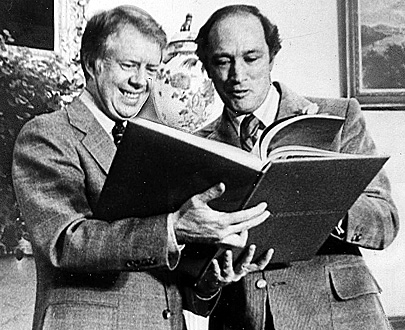

(The last time the loonie and greenback were at parity was in November 1976, when Pierre Trudeau was Prime Minister and just as Jimmy Carter was elected as the 39th U.S. president. In this photo, Trudeau presents a book to Carter at the White House in February, 1977, shortly after Carter took office. )

The last time the dollar was at par with the greenback was Nov. 25, 1976, when Pierre Trudeau was prime minister and René Lévesque had just become premier of Quebec. That high point for the currency signalled the beginning of a long slide for the loonie, as national unity concerns and mounting worries about Canada’s worsening government finances over the next decade or so scared away foreign buyers of the currency.

The loonie began to recover a bit after the former Liberal government began tackling the deficit, but has soared in recent years because of massive global demand for Canadian resources and the solid growth in the economy, especially in the oil-rich West.

“It really represents a very dramatic reversal of fortune from what would have happened 10 years ago when our resource economy made us look rust belt compared to the technological dynamo of the U.S. economy,” said CIBC economist Jeff Rubin.

The currency had advanced 1.38 cents Tuesday after the U.S. Federal Reserve cut short-term interest rates by half a percentage point, undercutting the attractiveness of the American currency. The loonie was also boosted as crude oil hit new highs solidly above $80 (U.S.) a barrel.

“It’s been a perfect environment for the Canadian dollar to strengthen,” said Craig Alexander, deputy chief economist at TD Economics.

“You’re getting a stronger Canadian dollar on positive economic news out of Canada, rising commodity prices, improving interest rates spreads and concerns about the U.S. dollar.”

Most forecasters weren’t anticipating the loonie to hit parity with the U.S. greenback at all – much less so soon and so quickly.

The No. 1 reason behind the sudden surge, Alexander said, “is that the U.S. Federal Reserve surprised financial markets by cutting interest rates by half a point.”

“That makes the Canadian dollar look more attractive to international investors because it means interest rates in Canada are less below those in the United States.”

The high dollar may make U.S.-made goods cheaper to buy in Canada and is a boon to Canadians travelling in the United States, especially cross-border shoppers and those looking to book winter vacations to Florida or Arizona. Those trips are suddenly much cheaper than they were a month ago.

But the high loonie will continue to put pressure on domestic manufacturers, who have to try to sell goods south of the border at a discount or have been priced out of U.S. markets.

Manufacturers such as lumber exporters, which have not had some insulation from commodity prices, and automakers will be particularly hard-hit, as the rising Canadian dollar makes exports less competitive at the same time that the shrinking U.S. housing market is making demand for housing weak.

Tourism in Canada could also be affected, as travel to Canada becomes more expensive to Americans – a drop that will likely ripple through the hospitality industry.

Rubin estimates that the manufacturing sector could see as many as 100,000 more jobs shed over the next 12 or 15 months, calling it the “obvious” loser of the rising loonie.

“It is getting crushed, no doubt about it, we lost a quarter million manufacturing jobs,” he said.

But, he added, “the pain and suffering in the manufacturing sector is nowhere evident when you look at the broad economic numbers.”

While the manufacturing sector has lost 289,000 jobs since late 2002, the economy has created more than one million jobs in resources, construction, services, health care, education and financial industries, leaving the national jobless rate at 30-year lows.

“Even in the province of Ontario, which is after all, the country’s manufacturing heartland, the unemployment rate is at a 20-year low … the energy sector is basically taking over our balance of payments.”

On the other side of that, importers will win big as the costs of bringing goods into Canada gets cheaper, as will whole sellers – the “middle men” in the economy.

It could also benefit consumers, who will see the purchasing power of their money rise.

But, Alexander warns, the surging loonie hasn’t yet trickled down to consumers.

“It is showing up in some areas like gasoline prices (and) retail areas like clothing and footwear, but broadly speaking, we haven’t seen a significant pass-through yet,” he said.

“Canadians that decide to do some cross-border shopping are benefiting, the increasing popularity of the Internet makes it possible for Canadian to buy things from vendors abroad, and to that extent they can benefit 100 per cent from the appreciation of the Canadian dollar.”

American-dollar weakness was also evident across most currencies Thursday as the greenback slumped versus the euro, the British pound, the yen and Swiss franc.

It dropped to record lows Thursday against the euro, which rose above the $1.40 (U.S.) level, the highest value for the European currency since its inception in 1999.

The spot gold price, meanwhile, topped $730 (U.S.) an ounce, trading at $742.60 (U.S.), up $13.10 (U.S.) on the day.

Some foreign exchange analysts in the U.S. have predicted the Canadian dollar could reach as high as $1.05 (U.S.) if weakness in the American economy persists.

Meanwhile, on the markets, losses in the energy sector helped keep the TSX in the red.

New York markets were lower after two days of strong gains in the wake of Tuesday’s half-point interest rate cut by the U.S. Federal Reserve.

Toronto’s S&P/TSX composite index was down 78.01 points to 13,861.77.

The TSX energy sector was down 1.4 per cent, after falling three per cent Wednesday, as investors took in a report calling for higher royalties to be paid by oil and gas companies in Alberta.

“Whenever you inject any type of uncertainty into a sector or into stocks, the first knee-jerk reaction of course is to sell and that’s what you’ve seen,” said Watson.

“This sector will probably be somewhat volatile leading up to the Alberta government’s actual decision coming up in mid-October.”

At the same time, the crude oil price moved further into record territory. The October crude contract in New York rose $1.04 to US$82.97 a barrel.

Shares in UTS Energy Corp. (TSX: UTS) were 16 cents, or 2.55 per cent, to $5.61 after falling almost 12 per cent Wednesday.

UTS has sold a third of its stake in the Fort Hills oilsands project in northern Alberta to partners Petro-Canada (TSX: PCA) and Teck Cominco Ltd. (TSX: TCK.B) for $750 million, calling its new share “an appropriate and meaningful level of participation.” UTS, which had a 30 per cent interest in the project, sold five per cent each to Teck and Petro-Canada.

The move means Petro-Canada now owns 60 per cent, leaving both UTS and Teck with a 20 per cent piece.

Elsewhere in the energy sector, EnCana Corp. (TSX: ECA) slipped 90 cents to $62.47 and Suncor Energy (TSX: SU) declined $1.92 to $94.61.

The TSX Venture Exchange gained 30.03 points to 2,788.48.

On Wall Street, the Dow Jones industrials moved down 30.24 points to 13,785.32 after gaining just over 400 points in the last two sessions in the wake of the Fed’s decision to lower its key interest rate to limit damage from the contracting U.S. housing sector.

The Nasdaq composite index declined 6.21 points to 2,660.27 and the S&P 500 index was down 5.63 points to 1,523.4.

Federal Reserve chairman Ben Bernanke said the credit crisis has created “significant market stress” and offered fresh assurances that regulators would take steps to curb fallout related to the mortgage mess.

“Global financial losses have far exceeded even the most pessimistic estimates of the credit losses on these loans,” the Fed chairman told the House of Representatives’ financial services committee.

Treasury Secretary Henry Paulson, who also scheduled at the committee’s hearing, signalled that the administration would consider allowing the big mortgage companies Fannie Mae and Freddie Mac to temporarily buy, bundle and sell as securities any loans exceeding US$417,000.

The idea, which represents a policy change for the administration, is portrayed as a way to inject liquidity into the stretched mortgage market.

Investors also took in a mixed earnings picture from the U.S. financial sector.

Goldman Sachs Group Inc. on Thursday reported quarterly profit rose to US$2.85 billion, compared with $1.55 billion a year earlier. Revenue soared 63 per cent to US$12.33 billion.

It said it took US$1.71 billion in credit losses in the quarter – including loans extended for leveraged buyouts.

Things weren’t quite so rosy at rival Bear Stearns.

Its profit plunged 62 per cent in the third quarter, as turbulence in the debt market rocked the investment bank’s credit portfolio.

Elsewhere on the TSX, the gold sector was the biggest advancer, up 2.2 per cent with the December bullion contract up $11.80 to US$741.30.

Yamana Gold Inc. (TSX: YRI) is hiking the cash portion of its takeover bid for Meridian Gold (TSX: MNG) by 63 per cent, or $253 million, and relaxing other conditions. Yamana shares were up 17 cents to $12.82 and Meridian shares ran ahead $1.94 to $34.69.

The base metals sector moved up 1.3 per cent. Teck Cominco Ltd. (TSX: TCK.B) advanced $2.04 to $48.68.

The industrials sector was a major drag, down 1.4 per cent as Canadian National Railways (TSX: CNR) gave back $1.34 to $56.50 and Bombardier Inc. (TSX: BBD.B) shed 31 cents to $5.74.

Shares in Cott Corp. (TSX: BCB), the world’s largest retailer-brand soft drink company, fell $2.01 or 19.4 per cent to $8.29 after it lowered its 2007 earnings forecast and predicting flat revenue growth in “one of the most challenging years in Cott’s history.”

The financials sector moved down one per cent. Shares in Scotiabank (TSX: BNS) fell 91 cents to $51.79 after it expanding its relationship with IBM Corp. in a new IT outsourcing deal that’s expected to cost $480 million over the next six years.

Utility company Boralex Power Income Fund (TSX: BPT.UN) says its special committee has ended its sale process and it’s blaming a slump in financial markets. Its units dipped 31 cents to $9.21.

In 1976, when the dollar was last at par…

Pierre Trudeau was prime minister and Bill Davis was premier of Ontario.

Gerald Ford was president of the United States. Jimmy Carter was elected president in November, assuming power in 1977.

The CN Tower opened in Toronto.

The Canadian parliament voted to abolish the death penalty.

The median household income in the U.S. was $12,686, unemployment was at 7.7 per cent and the price of a first-class stamp was 13 cents.

The 1976 Olympics were held in Montreal. Pittsburgh Steelers won the Super Bowl, the Cincinnati Reds won the World Series and the Montreal Canadiens won the Stanley Cup. Chris Evert won the Wimbledon ladies’ championship and Bjorn Borg won the men’s title.

Toronto Maple Leafs’ Darryl Sittler set a record by scoring 10 points in one game.

In 1976, One Flew Over the Cuckoo’s Nest won the Oscar as Best Picture and Love Will Keep Us Together by Captain and Tennille won the Grammy as record of the year.

In world events, Israeli commandos attacked Uganda’s Entebee Airport and freed 103 hostages held by pro-Palestinian hijackers of an Air France plane. One Israeli and several Ugandans were killed in the raid.

Compiled by Curtis Rush