Residential real estate values in major Canadian markets

post extraordinary gains over 25-year period, says RE/MAX

(For immediate release)

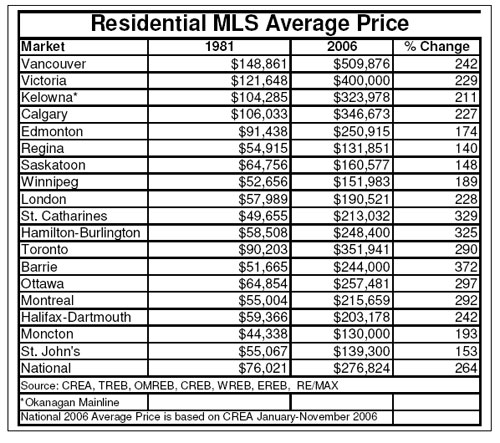

Mississauga, ON (January 24, 2007) – Residential housing values in virtually all major Canadian centres have posted significant gains since 1981, with almost half reporting double-digit appreciation annually, according to RE/MAX. Leading the charge is Barrie, Ontario with an exceptional 372 per cent increase in average price ($51,665 to $244,000) over the 25-year period.

Despite the cyclical nature of the business, an analysis of 17 housing markets across the country found that price appreciation topped 240 per cent in seven areas, including Barrie (372 per cent), St. Catharines (329 per cent), Hamilton-Burlington (325 per cent), Ottawa (297 per cent), Greater Toronto Area (290 per cent), Greater Vancouver Area and Halifax-Dartmouth (242 per cent increase). Victoria reported a 229 per cent increase, London experienced an upswing of 228 per cent, Calgary was up 227 per cent, and Kelowna rounded out the top 10 at 211 per cent.

“Conventional wisdom used to be that real estate was a relatively safe, long-term investment that typically appreciates at a rate of five per cent annually,” says Michael Polzler, Executive Vice President and Regional Director, RE/MAX Ontario-Atlantic Canada. “These statistics clearly tell a different tale. In the top ten markets, real estate values rose at least eight per cent or more on an annual basis. Even the worst performing market in the country experienced an increase of close to six per cent annually since 1981.”

Nationally, average price appreciated 264 per cent (11 per cent annually) in the 25-year period, rising from $76,021 to an estimated $277,000 in 2006. Although a number of factors contributed to the substantial upswing in values, perhaps the greatest influence was a 25 per cent increase in Canada’s population (which rose from 24,820,393 to a projected 31,021,251 in 2005).

“The results are nothing short of remarkable, given the economic volatility of the marketplace in the past 25-year period,” says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. “This is especially true in recent years when serious external factors such as 9/11, SARS, and an outbreak of forest fires barely registered on housing activity. Any one of these disasters would have had a significant impact on real estate markets in the 1980s.”

Thanks to economic diversity, today’s housing markets are more insulated than in the past. Alberta’s probusiness stance, for example, has served to attract major corporations to the province in recent years.

Saskatchewan’s economic base has shifted from agriculture to natural resources virtually overnight. In Ottawa, an economy once solely dependent on the one major employer in the area, the evolution of high-tech has played a substantial role in the overall health of the residential real estate market.

“Immigration has also bolstered residential home sales, particularly in Canada’s largest cities,” says Polzler.

“Approximately 250,000 new Canadians arrive annually and we know from experience that many will buy a home within five years of immigrating. Job opportunities have also prompted in-migration across the country as purchasers from more rural communities seek employment in major metropolitan areas.”

Baby Boomers have also been a powerful force behind housing demand, explains Ash, particularly in the upper end where sales have surged in recent years. “Boomers have demonstrated their buying intentions through the purchase of primary residences, recreational and retirement properties and even in financially assisting their children—the next generation of homebuyers—thereby stimulating the first-time segment as well.”

RE/MAX is Canada’s leading real estate organization with over 16,880 sales associates situated throughout its more than 630 independently owned and operated offices across the country. The RE/MAX franchise network, now in its 33rd year of consecutive growth, is a global real estate system operating in over 63 countries. More than 6,740 independently owned offices engage 119,400 member sales associates who lead the industry in professional designations, experience and production while providing real estate services in residential, commercial, referral, relocation and asset management. For more information, visit: www.remax.ca

###

For more information:

Christine Martysiewicz Eva Blay/CharleneMcAdam/Kim Kofman

RE/MAX Ontario-Atlantic Canada Point Blank Communications

905.542.2400 416.781.3911

Market 1981 2006 Change(%)

Vancouver $148,861 $509,876 242%

Victoria $121,648 $400,000 229%

Kelowna* $104,285 $323,978 211%

Calgary $106,033 $346,673 227%

Edmonton $91,438 $250,915 174%

Regina $54,915 $131,851 140%

Saskatoon $64,756 $160,577 148%

Winnipeg $52,656 $151,983 189%

London $57,989 $190,521 228%

St. Catharines $49,655 $213,032 329%

Hamilton-Burlington $58,508 $248,400 325%

Toronto $90,203 $351,941 290%

Barrie $51,665 $244,000 372%

Ottawa $64,854 $257,481 297%

Montreal $55,004 $215,659 292%

Halifax-Dartmouth $59,366 $203,178 242%

Moncton $44,338 $130,000 193%

St. John’s $55,067 $139,300 153%

National $76,021 $276,824 264%

*Okanagan Mainline

National 2006 Average Price is based on CREA January-November 2006

Residential MLS Average Price

Source: CREA, TREB, OMREB, CREB, WREB, EREB, RE/MAX

http://www.remax-oa.com/MarketReports_PDF/Jan2007/REMAX_25_Years_in_Real_Estate_REL.pdf